Maximizing Value from Hydrocarbons

| Code | Duration | Currency | Fee Per Person |

|---|---|---|---|

| PEA-HRC |

10 Hours

|

USD

|

500

|

This is a self-paced, on-demand e-learning course. Upon enrollment, all course videos and materials will be delivered to your email within 12 hours. A certificate will be issued upon successful completion of the required quizzes and assignments.

Boost your team's skills and your budget! Enjoy group discounts for collaborative learning. Send an inquiry to info@peassociations.com.

Maximizing Value from Hydrocarbons

This 3-module e-learning course offers a holistic view of the upstream value chain. Participants will gain technical mastery over Primary, Secondary, and Enhanced Oil Recovery (EOR) methods, while simultaneously developing the commercial acumen to evaluate project economics using NPV and IRR. The course concludes with a deep dive into resource estimation and the SPE-PRMS classification framework.

Description

In the modern energy landscape, technical proficiency alone is not enough; professionals must understand how engineering decisions impact the bottom line. Maximizing Value from Hydrocarbons is designed to bridge the gap between subsurface engineering and strategic business management.

How do you determine if a reservoir is technically produceable and commercially viable? This course answers that question by integrating three critical disciplines: reservoir engineering, project finance, and reserve auditing. Through interactive digital modules, we guide you from the physics of flow in porous media to the complexities of economic decision-making under uncertainty

Evaluate Recovery Methods: Distinguish between Primary, Secondary, and Enhanced Oil Recovery (EOR) and select appropriate strategies based on reservoir properties.

Analyze Economics: construct cash flow tables and calculate key economic indicators such as Net Present Value (NPV), Internal Rate of Return (IRR), and Profitability Index (PI).

Manage Risk: Apply sensitivity analysis and Monte Carlo simulations to assess project uncertainties.

Estimate Resources: Utilize volumetric, material balance, and decline curve analysis methods to estimate hydrocarbon volumes.

Classify Reserves: Categorize assets according to the SPE-PRMS framework (Proved, Probable, Possible) and understand the distinction between Reserves and Contingent Resources.

Integrated Decision Making: A workforce that understands the link between technical recovery factors and economic outcomes.

Standardized Reporting: Improved compliance with global standards (PRMS) for reserve reporting and auditing.

Risk Mitigation: Better project evaluation through the application of decision trees and Expected Monetary Value (EMV) analysis.

Asset Optimization: Strategies to extend field life through appropriate EOR selection.

Commercial Acumen: The ability to speak the language of management (Capex, Opex, ROI).

Technical Versatility: A broadened understanding of recovery mechanisms beyond day-to-day operations.

Analytical Skills: Proficiency in using probabilistic methods (P10, P50, P90) for resource estimation.

Strategic Insight: Understanding how oil price and production rates influence the viability of a project

Reservoir and Production Engineers.

Geoscientists and Petrophysicists.

Petroleum Economists and Asset Managers.

Business Development Executives in Oil & Gas.

Engineers transitioning from technical to techno-commercial roles.

Module 1: Recovery Mechanisms & Reservoir Management

Fundamentals: Definition and importance of recovery mechanisms in reservoir management.

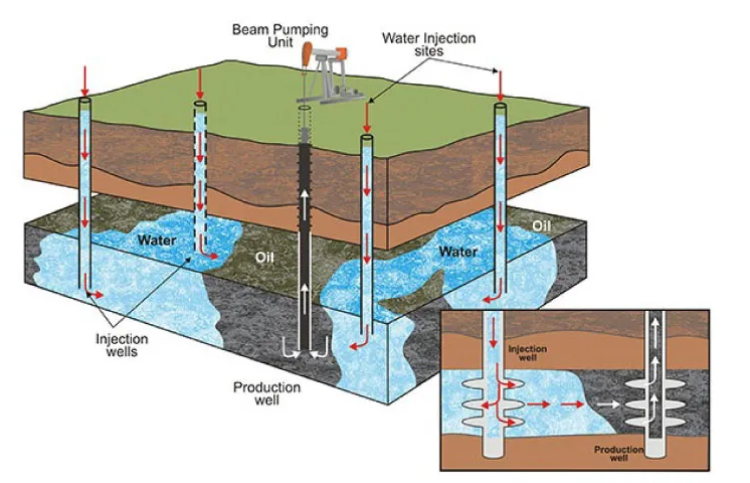

Primary Recovery: Natural drives (Solution gas, Gas cap, Water drive) and their limitations.

Secondary Recovery: Objectives of Waterflooding and Gas Injection for pressure maintenance and sweep efficiency.

Enhanced Oil Recovery (EOR):

Thermal methods (Steam flooding, In-situ combustion).

Chemical methods (Polymer and Surfactant flooding).

Gas-based methods (CO2 and Miscible gas injection).

Influencing Factors: Impact of porosity, permeability, viscosity, and well placement.

Module 2: Petroleum Economics & Risk Analysis

The Economic Framework: Role of economics in decision-making and components of Cash Flow (Opex, Capex, Royalties, Taxes).

Key Indicators: Calculating NPV, IRR, Payback Period, and Profitability Index.

Sensitivity Analysis: Assessing the impact of oil price and production variables using Tornado diagrams.

Decision Making: Using Expected Monetary Value (EMV), Decision Trees, and the "Value of Information" concept.

Module 3: Hydrocarbon Resource Estimation & Classification

Estimation Methods:

Volumetric Method (Reservoir volume, porosity, saturation).

Material Balance (Pressure data) & Decline Curve Analysis (Production trends).

Reservoir Simulation for dynamic prediction.

Classification Frameworks: Deep dive into the SPE Petroleum Resources Management System (PRMS).

Categories: Defining Reserves (Proved, Probable, Possible), Contingent Resources, and Prospective Resources.

Uncertainty: Applying probabilistic methods (P10, P50, P90) to technical and economic data.

On successful completion of this training course, PEA Certificate will be awarded to the delegates.

This course has been meticulously developed by a seasoned PEA expert renowned in the oil and gas industry. With extensive hands-on experience and a proven track record in delivering innovative solutions, our trainer brings a wealth of technical expertise, deep industry insight, and a commitment to excellence. Learners can trust that they are gaining knowledge from a leading authority whose dedication to professional development ensures you receive only the highest-quality training to elevate your skills and career prospects.